Retirement Life

6 March 2024

Everything you need to know about rates rebates

If you own a home, you’ve undoubtedly noticed that rates – the fees that local councils charge property owners to fund public services and infrastructure – are rising rapidly. According to Stats NZ, the local authority rates portion of the consumer price index increased 7.3 percent in the year to June 2023 - the highest annual increase since the series began in 1999.

It doesn’t take a finance degree to understand what’s driving these hikes. Councils up and down the country are grappling with skyrocketing costs of providing essential services like roads, water, waste, parks, libraries, and community facilities at the same time as many such services are suffering from major wear and tear. And the rates home (and business) owners pay are far and away councils’ dominant revenue stream.

That doesn’t make it any easier for those footing bigger bills. Rates can be a significant expense for many homeowners, especially for retirees who rely on a fixed income.

The Rates Rebate Scheme

The good news is you could be eligible for the government’s Rates Rebate Scheme: a partial refund for eligible, low-income ratepayers who pay rates on their home to the council. The scheme is administered by the Department of Internal Affairs in partnership with local councils and it’s updated every year to reflect changes in inflation and income levels.

Who is eligible for a rates rebate?

To qualify for a rates rebate:

- You must be the person who pays the rates on the property that is your home (i.e. your name is on the rates bill).

- You must be living in your home on 1 July of the current rating year and apply before 30 June of the following year (i.e. before 30 June 2024 for this rating year).

Take the first step towards a successful Retirement!

What about retirement villages?

If you live in a retirement village, you may still be eligible for a rates rebate if you have a licence to occupy or a similar right to live in your unit. You’ll need to ask your village operator to complete a declaration form, which you can access on the NZ Government website, here. You’ll need to provide this declaration form when you apply for your rates rebate.

The same goes if you live in a company-share apartment - you might be eligible for a rates rebate if you have a share in the company that owns the property and you pay rates to the company. You need to ask the person who is responsible for paying rates for the whole property to sign a declaration form, which you can find here.

If you’re a resident of a trust-owned property, you can apply for a rates rebate if you are a named trustee and the rates bill is in your name (i.e. you are named on the council rating information database).

How much can you get off your rates bill?

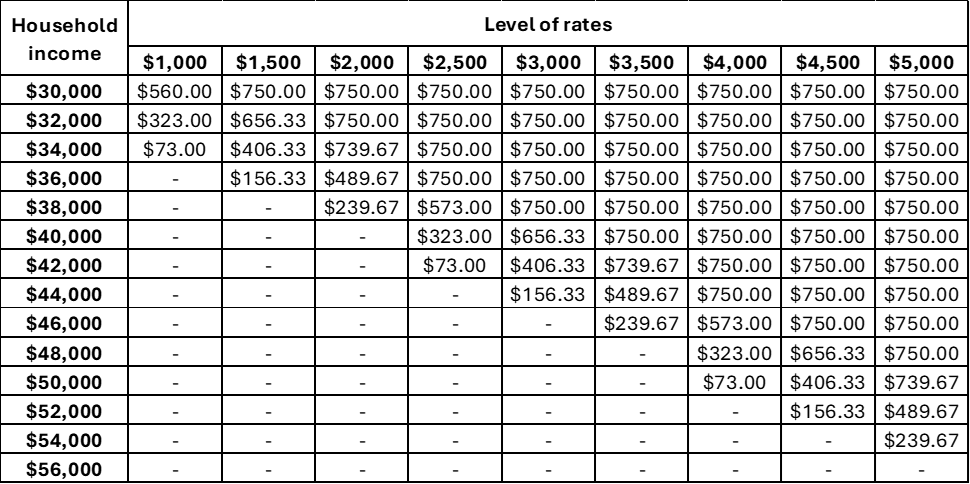

The amount of any rates rebate depends on your income, your rates, and your dependants. The maximum rebate for the 2023/2024 rating year is $750.

The table below provides examples of the amount you might get deducted from your rates bill. Otherwise, you can use the rates rebate calculator on the NZ Government website, by clicking here. Both the table and calculator are only guides and do not guarantee your eligibility or the amount of your rebate.

Examples of the amount of rates rebate you may be entitled to with no dependants

Source: rates rebate application form

How do you apply for a rates rebate?

If you think you’re eligible for a rates rebate, you need to apply to your local council by 30 June 2024. You can find the application form and more information on the NZ Government website, here.

You’ll also need to provide proof of your income, including whatever you receive through New Zealand Super or the Veteran’s Pension, and other income sources, if you have one. You can find your annual income amount on your IR3 tax summary from Inland Revenue, or by logging into your MyIRD account, here. Alternatively, you can call the IRD on: 0800 227 774.

If your application is successful, your council will deduct the amount of your rebate from your rates bill or refund you if you have already paid your rates in full.

Calculate what you could draw in retirement.

The clock is ticking!

The Rates Rebate Scheme provides valuable support to low-income homeowners who pay rates to their council. It can help reduce the financial burden of rising rates, especially for retirees who live on a fixed income. If you’re eligible and not already signed up to the scheme, make sure you apply to your local council before 30 June this year.

Invest with Lifetime for a retirement income managed for living.