Retirement Life

14 August 2024

Is it time to ‘cash out’?

Many savers have been tempted to lock up their loot over the past couple of years as Term Deposits offered their highest rates in more than a decade. However, now that the Reserve Bank (RBNZ) seems to be getting somewhere in the fight against inflation, interest rates are likely to head south soon. And where interest rates go, Term Deposit rates follow.

The consequence for savers is simple: lower Term Deposit rates equal lower returns.

Unpredictable income

Consider the following table, which looks at the RBNZ’s interest rate forecast over the next two years and what that could mean for someone rolling over $250,000 in a six-month Term Deposit (assuming a tax rate of 17.5%):

|

$250K invested |

Today |

6 months |

12 months |

18 months |

24 months |

|

Six-month TD rate |

6.0% |

5.30% |

4.50% |

4.20% |

3.90% |

|

Net return (after tax) |

4.95% |

4.37% |

3.71% |

3.47% |

3.22% |

|

Monthly income (after tax) |

$1,031 |

$911 |

$773 |

$722 |

$670 |

RBNZ CIP estimates; TD premiums average over last 12 months

Calculate what you could draw in retirement.

It’s clear that returns are going to get progressively less appealing in the months to come. Yet, even in a high-rate environment, Term Deposits are not the ideal set up for optimising income in retirement. For starters, you can’t touch your money for the term of the deposit without incurring penalties, even in an emergency, and real (after tax) returns are unpredictable and typically lower than the pace at which consumer prices are rising (inflation, in other words).

No drawdown option to supplement retirement income

Term Deposits are no longer seen as an effective retirement income strategy as they do not facilitate the gradual drawdown of savings over time. Few people are fortunate enough to generate an adequate supplementary retirement income from returns alone, meaning capital depletion is essential. If you do chip away at your capital prior to rolling it over into another Term Deposit, your return, and therefore income, would be lower each time.

Why decumulation funds are better for retirement income than term deposits

Specialised retirement income decumulation (or drawdown) funds, like the one at Lifetime Retirement Income, are designed precisely to overcome these limitations and provide a stable, reliable and sustainable retirement income over a long period. To do this, Lifetime seeks to optimise capital by investing in a diversified portfolio of assets, while using risk management tools to moderate the impact of market volatility on returns.

Each customer is unique and so too is their regular fortnightly income payment. To calculate this, Lifetime factors in a client’s starting retirement savings, age, gender, tax rate, lifestyle choices, mortality risk and inflation tolerance. Using the example above, a $250,000 investment with Lifetime could net a monthly income of $1,056, carefully managed to last until age 95, at which point their capital is depleted.

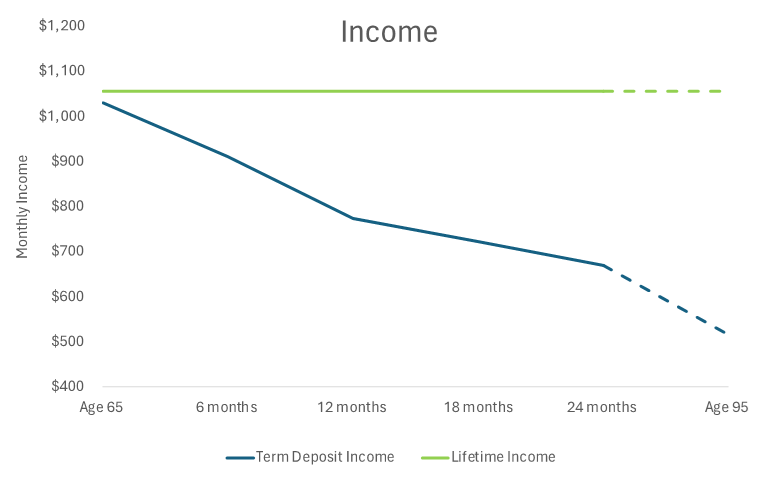

The following chart illustrates the difference between the income derived from a specialist retirement income drawdown fund (based on capital + returns) and rolling six-month Term Deposits (returns only):

TDI from 24 months based on RBNZ average rate for six-month TDs over the last 10 years; 3% gross. Lifetime Income is not guaranteed and could fluctuate. The projection is based on an expected return of 5.5% p.a., fees of 1.35% and tax at 17.5% p.a.

As you can see, the green line represents the steady income from a $250,000 investment in a decumulation fund like Lifetime’s, calculated to last until age 95. The blue line shows the fluctuating income from a Term Deposit, which becomes less reliable as interest rates fall. Noting the decumulation fund pays both capital and investment returns, whereas the term deposit only pays investment returns.

Optimising income in retirement

Retirement income decumulation funds are designed to manage the complex calculations required to pay a retiree a stable and predictable income from their savings that lasts their lifetime. Term Deposits offer a return tied to prevailing interest rates and no facility for a retiree to manage the gradual drawdown of their capital, which is essential for most people to maximise quality of life in their post-work years. As interest rates begin to fall from their recent peak, the case for careful, expert oversight of retirement savings to pay a secure income becomes stronger than ever.

Learn more about how Lifetime Retirement Income works – Click to View

Project your retirement income.

Invest with Lifetime for a retirement income managed for living.