Retirement Life

19 July 2023

Spring clean your finances

Moving into retirement can be one of the biggest changes in life, a developmental stage that comes at a time of life when we are not always good at coping with change. On retirement our lives change, and, in some crucial areas, our finances might need to change, too.

I think retirement is a trigger to have a good look at your affairs and arrangements. It may be that many financial areas have not been taken out of the box for a while, and it is time to dust them off and give them a spring clean.

Your will

There is nothing about retirement that might mean that you have to change your will, but while you are having a spring clean of your finances, taking out your will to have a look seems a good thing to do. This is especially so if your will is old – it may be years or even decades since you have given it a check-up, and you might think a bit differently now.

I had some life changes a few years ago and had another look at my will. While I basically left it (nearly) unchanged with everything to my three children, I had a think about my four grandchildren. The change I made was to leave money to each of these grandchildren. I directed that this money go to the grandchildren’s KiwiSaver accounts so that each of them would have money towards the deposit on their first home.

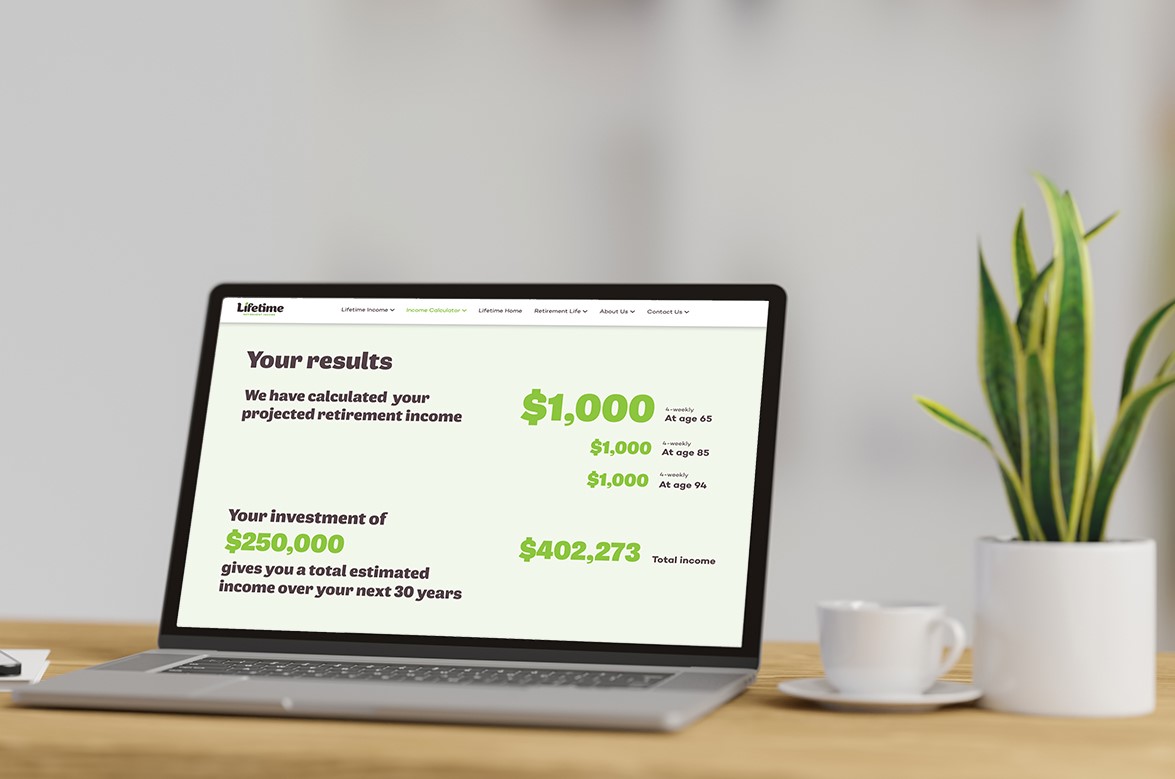

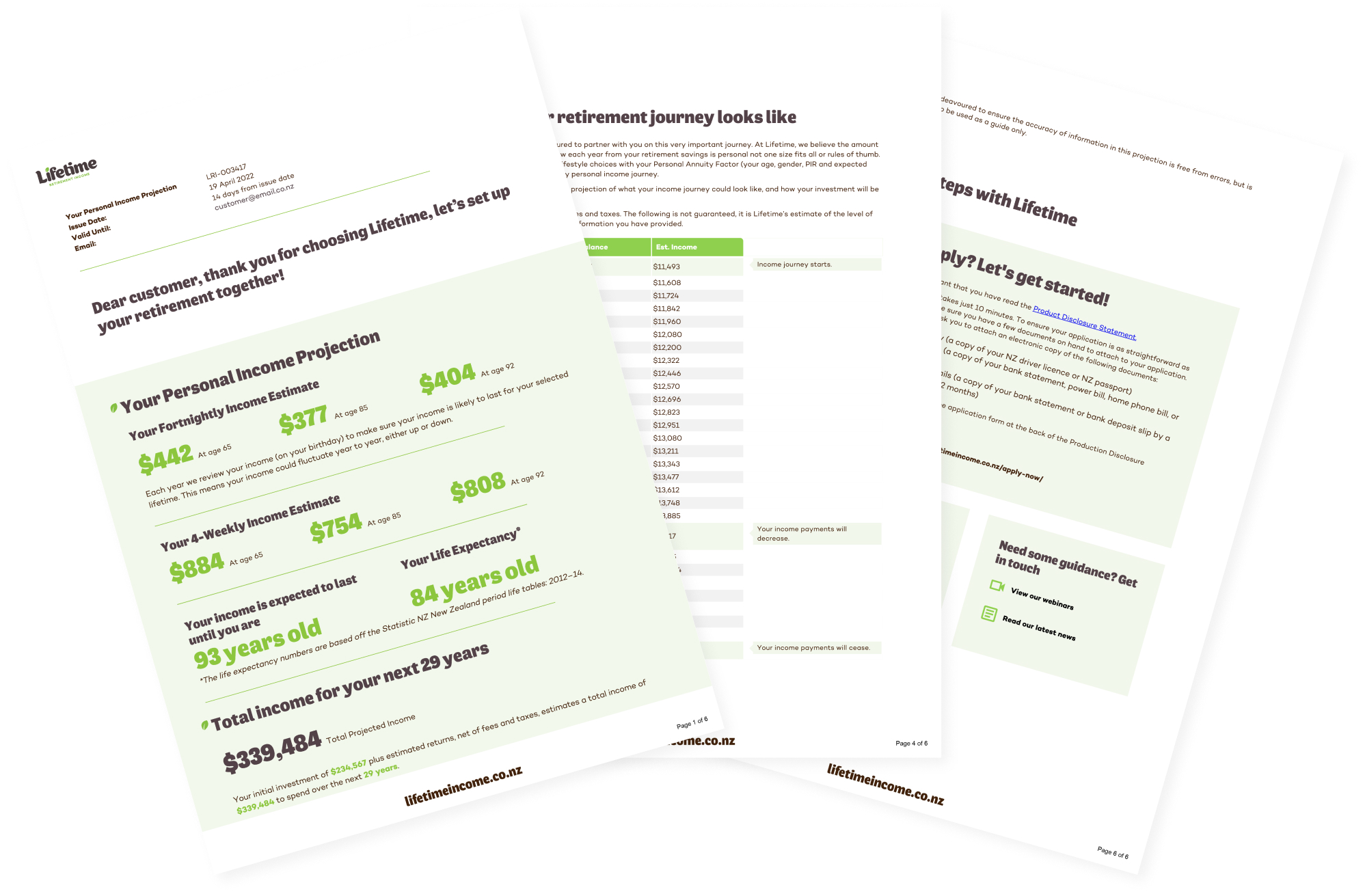

Calculate what you could draw in retirement.

Your family trust

Family trusts are changing – and so are you. This would be an excellent time to reconsider any trust that you have settled and, in particular, to think about why you formed the trust and whether the reason(s) for it are still of concern. Many people settled trusts to protect personal assets in case their business strikes trouble – maybe the business is sold now and asset protection is no longer a worry. There are others whose trusts were started for tax reasons, relationship property, succession, asset testing and others. Check that these are still concerns in retirement (for example, in retirement your income may be lower and so tax is of less concern).

At the same time, the laws around trusts change. In fact, as I write, Parliament is considering a change in the trust tax rate from 33c to 39c which may make your trust less useful or, at least, change the way income should be distributed. While reviewing your trust, make sure the way that it is managed complies with the Trusts Act 2019 and that it would withstand scrutiny from anyone who might want to attack it.

Insurances

When you retire, risk can change. A good example of that concerns life insurance and income replacement insurance. Before retirement, a family is likely to be dependent on people working. Both life insurance and income replacement insurance may be necessary so that if the main income earner dies or is disabled, insurance can fill the gap. However, once you are in retirement, income probably comes from NZ Super and investments, and so insurance against disability or death is no longer necessary.

While considering insurances, you should look at your general insurance (house, contents, car etc) to make sure that they are right. In particular, consider your house insurance – now that home insurance works on a nominated amount, you should check that the amount you have nominated would allow you to rebuild (many people have nominated amounts that are well under the cost of replacement).

Income and expenditure

This is something that you will almost certainly have a look at as your income and probably your expenditure will change. Mostly you will consider how much your income will be and where it will come from, but you have to realise that your expenditure may actually increase when you retire as you travel and do things. Remember also that your expenditure will not stay constant through retirement but instead will be higher in the early years and then gradually fall as you age. That’s good – you should make the most of the early years of retirement as you may not be able to do some things as you get older.

My experience is that the desire to make gifts to children and grandchildren increases as you age. I make regular gifts to grandchildren, contributing weekly to their KiwiSaver accounts and budget for this.

Project your retirement income.

This spring cleaning does not need to take a lot of time or effort. However, retirement does seem such a major break from the way that we have lived that we should clean up our finances spic and span for the summers ahead.

Invest with Lifetime for a retirement income managed for living.