Retirement Life

1 November 2022

The importance of cash

The recent drop in investment values has caused concern for many retirees. Liz Koh looks at the role of cash and its importance within a portfolio of assets.

The recent drop in investment values has caused concern for many retirees. However, for those investors who understand the role of cash in an investment portfolio and who have set funds aside in stable investments, there is no need for worry.

The word ‘cash’ has a very different meaning now than it did a few decades ago, but it is still a vital part of a financial plan. Cash provides liquidity; that is, money when you need it. Liquidity can take many different forms. It can be notes and coin, bank deposits, credit – a line of credit or a credit card – or a financial asset that can be quickly and easily sold, such as bonds or shares. Ideally, liquid assets should be available immediately, if required, with no cost or risk of loss of value associated with access to the funds.

The various forms of liquidity have different advantages and disadvantages. The choice of how to access cash depends very much on personal circumstances and goals. The most liquid assets are notes and coin, and bank call deposits. While they are easily accessible, there is the possibility of physical loss with notes and coin, as well as cost, due to their low investment return. Shares offer good liquidity and the potential for investment return, but they are volatile, and there is the possibility of investment loss should funds be required at a specific time which may coincide with a drop in the market. Using credit lines for cash is fast and easy but may come with a high interest cost.

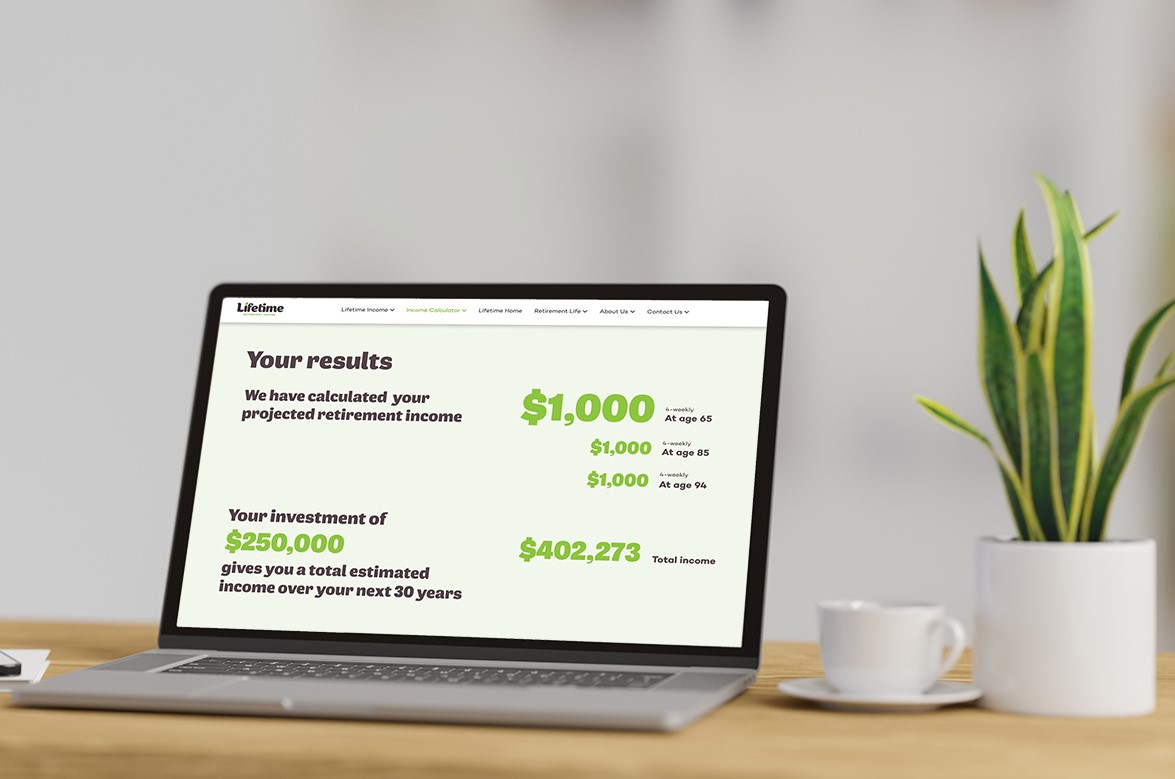

Dynamic Retirement Income Solutions Found Here.

Design your income today!

The Lifetime Retirement Income Fund is liquid (90%) and can accessed for emergencies, this is however a last resort, as the purpose of the fund is to provide an income for life with any withdrawals reducing the amount of retirement income paid.

Outside of your retirement income solution, if you are also planning an investment portfolio, it is important to get an idea of just how much when planning an investment portfolio, it is important to get an idea of just how much cash you might need to get your hands on, either in the short term or at short notice. This includes both planned spending and provision for unplanned expenditures such as unexpected health costs or home maintenance costs.

Investments that are highly liquid and stable in value come at a cost, as the investment returns are usually low. There is a balance to be had between liquidity and return. The trick is to set aside just enough money in liquid, stable investments to cover short-term spending and emergency needs, and to invest the rest for the long-term in assets that have a higher return but are either less liquid or more volatile.

Investing for liquidity is different from investing for return. The goals of investing for liquidity are to ensure you have access to money when you need it and that there is little risk of loss. The investment return is secondary to these goals.

When building an investment portfolio one approach is to have layers of liquidity. For example approach is to have layers of liquidity. For example, you can have some funds in call accounts, some in short term deposits, some in longer term deposits and some in other relatively stable investments such as bonds or bond funds.

A simple approach to ensure you have cash on hand when you need it is to set up a series of term deposits with your bank, each with a different maturity. For example, you could set up four term deposits maturing six months apart (6, 12, 18 and 24 months) which in total will cover your cash needs for the next two to four years. As each term deposit matures, take out what you need to top up your call account and reinvest the remainder for two years. By reinvesting for two years, you will maintain the six-month gap between maturities.

This system allows you to have funds available every six months but with the advantage of receiving a two-year interest rate. Another advantage of this approach is that it reduces reinvestment risk by splitting your cash funds into segments, each of which is invested and reinvested at a different interest rate. Reinvestment risk is the risk that comes from not knowing what interest rates will be at the point of maturity. If you were to invest all your funds in one lump sum, your reinvestment risk would be much higher than if the funds were split into sums with different maturities, each of which is reinvested at a slightly different rate.

Want to spend more money earlier in your retirement?

Lifetime offers this!

Having part of your investment portfolio tucked away in term deposits or other stable, liquid investments means that when the value of your long-term portfolio drops, you are able to leave it untouched while the value recovers, using your liquid funds instead to cover your short-term spending needs. Cash is an integral part of any portfolio as it offers protection from volatility along with peace of mind.

Invest with Lifetime for a retirement income managed for living.