News

15 November 2018

3 big questions

What are 3 big questions we often get asked about Lifetime?

1) How does Lifetime keep my savings secure?

Lifetime is designed to protect your capital and make it last as long as possible.

Lifetime is an insurance company licensed by the Reserve Bank of New Zealand. This is important as the Reserve Bank only licenses two types of financial organisations; insurance companies and banks.

As a licensed insurer, Lifetime is subject to strict governance and supervision. In order to offer a lifetime income guarantee, the Reserve Bank requires Lifetime to hold sufficient capital in order to meet its future obligations. Capital must be held separately in a statutory fund, which is regularly monitored by the Reserve Bank.

The Reserve Bank can require Lifetime to hold more capital if financial markets deteriorate and/or Lifetime’s customers have longer than expected lifespans.

The Government-owned Public Trust is the supervisor and custodian of the Lifetime Income Fund. When you invest with Lifetime, your savings are deposited into a Public Trust bank account and held separately from Lifetime.

The Public Trust invests your savings with the investment managers of the balanced fund (Vanguard, ANZ, NZX, and Harbour Asset Management) in the assets stated in the Product Disclosure Statement.

The Public Trust supervises the administration of your capital at all times. Lifetime can only withdraw capital from your investment account in the event of; making Insured Income payments to you, paying the fees and tax on your investment, or if you instruct Lifetime to withdraw all or part of your investment.

As a fund manager, Lifetime is monitored by the Financial Markets Authority (FMA). Lifetime reports to the FMA every month on its financial performance and management of investors’ money.

The Government-owned Public Trust is the Supervisor and Custodian of the Lifetime Income Fund.

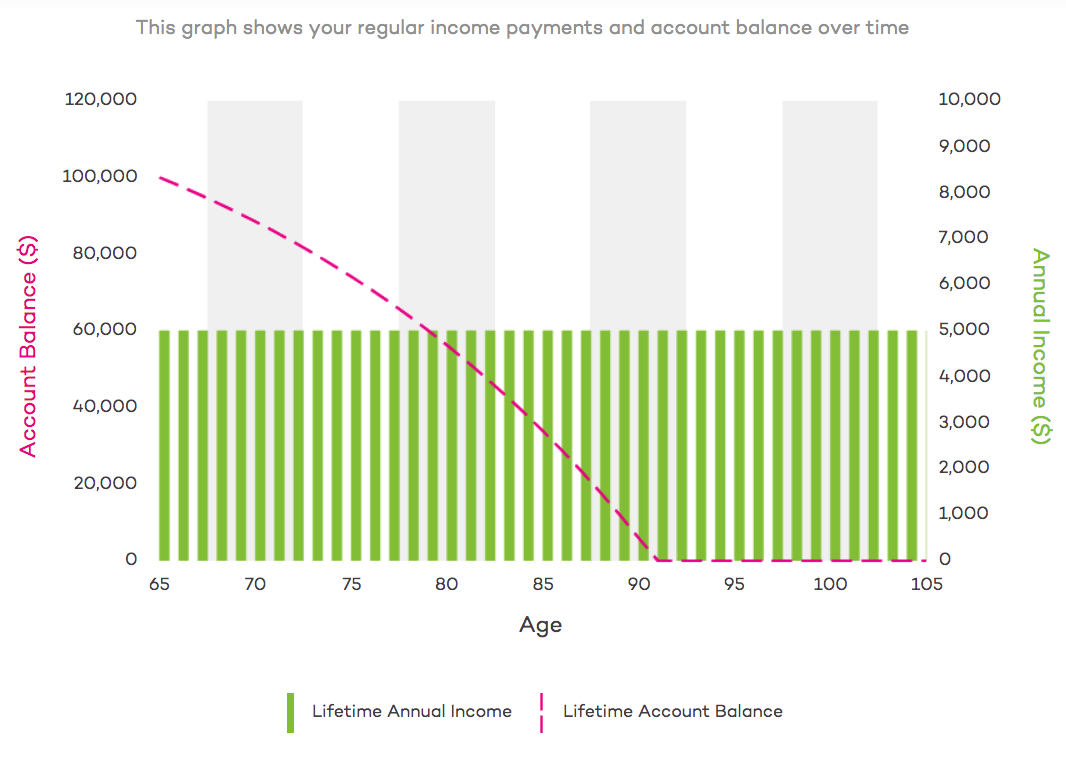

2) Why does your graph show that my investment declines over time?

When you invest with Lifetime, your savings are invested in a balanced fund and your income is insured for life.

The balanced fund is similar to a KiwiSaver fund and provides you with a market investment return. Regular withdrawals are made to fund your fortnightly Insured Income payments (unless you have chosen to defer your income).

In years where net investment returns are greater than your income payments, the difference is credited to your account and your Insured Income may rise proportionately.

In years where net returns are less than your income, you’ll drawdown some capital to make up the difference. Your Insured Income will remain unchanged.

The reason the pink line declines on the graph is because your annual Insured Income is expected to be higher than the average projected return of the balanced fund (6.50% p.a. before fees and tax).

This means that over the course of a long retirement, it's possible your regular income withdrawals may eventually drawdown your account balance. However, this doesn't mean you'll run out of income. Lifetime’s longevity insurance ensures you continue to get your regular income payments for life.

This gives you certainty. You know you’ve got money coming in every fortnight to pay the bills, just like when you were working. You also don’t have to worry about stock market crashes or low interest rates affecting your income.

3) Is my income protected from inflation?

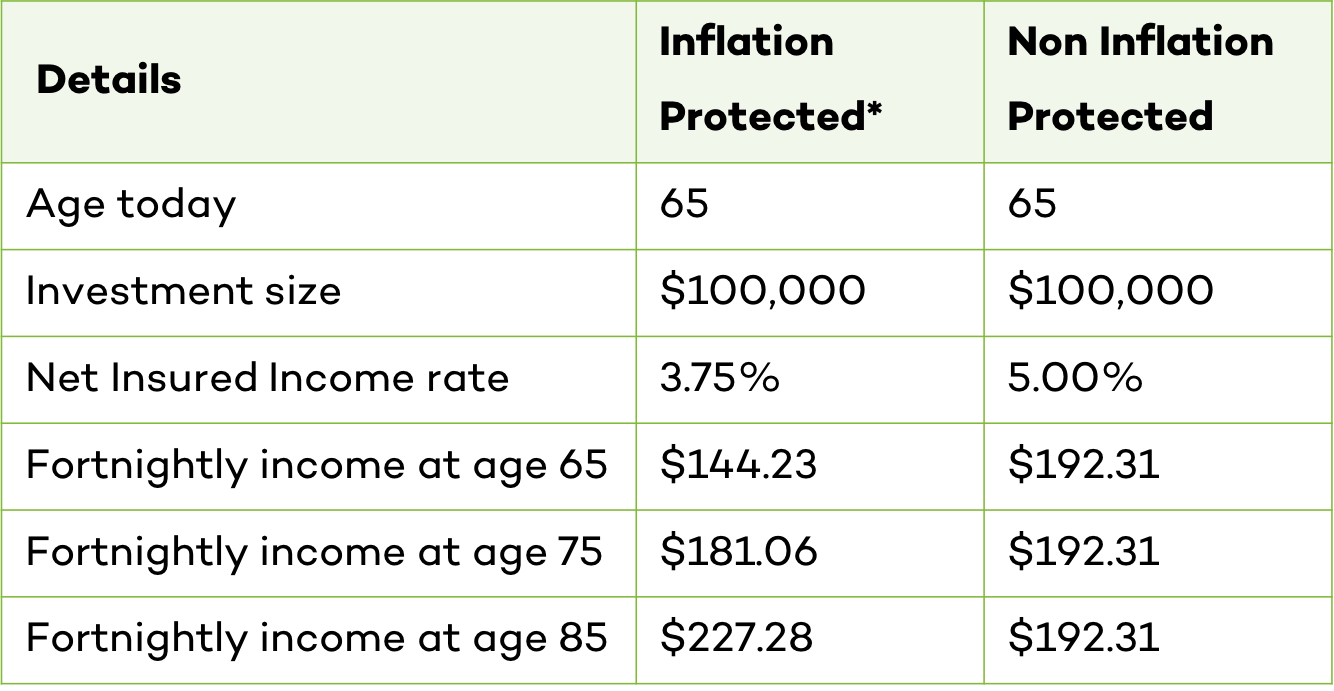

Lifetime can offer you an inflation-protected income for life option which increases each year in line with New Zealand Superannuation. This is done on a quote basis and the net income rate is typically around 25% lower than Lifetime's standard net income rates. For example, this would be around 3.75% p.a. (after fees and tax) for a 65-year-old instead of 5.00% p.a. (after fees and tax).

You therefore receive less income today but get increasingly more income in the future. However, in the current low inflation environment, we expect the average investor to be better off by choosing a non inflation-protected product.

Inflation has been steady and reasonably low for quite some time. According to the Reserve Bank of New Zealand, the average annual rate of inflation over the last 30 years has been 2.30% per annum. You can see this data here.

Most retirees tend to also spend more in early retirement than in later years, even taking into account greater spending on healthcare when they're older. You can read more on this here.

So what should you do?

Let's have a look at an example of someone who invests $100,000 at age 65 and compare the difference between choosing an indexed or non-indexed option.

According to the Reserve Bank of New Zealand, the compound average annual rate of inflation over the last 30 years has been 2.30% per annum.

On the table, you can see that their income is initially lower with the indexed option but rises each year in line with inflation. At an assumed long run inflation rate of 2.30% per annum, it's expected to take 13 years before it exceeds the amount of income offered by the non-indexed option.

Lifetime is designed to help you top up NZ Super to help you meet your fortnightly living costs. NZ Super is indexed at 66% of the average wage (which tends to rise faster than CPI inflation) and will likely make up the a significant proportion of your retirement income. This means a large amount of your income is indexed (via NZ Super) anyway so the need to find inflation protection elsewhere is lessened.

Higher inflation tends to increase investment returns and interest rates. Although your income rate may be fixed, you will capture these higher returns in the form of increased returns from the balanced fund your money is invested in.

Your investment with Lifetime is always liquid, which simply means your initial investment plus net investment returns minus income payments received can be redeemed at any time.

If inflation were to rise in the future, you have the option to add to your investment to top up your regular payments. Your income rate would also be higher as you would likely be older when this occurs. Investing in stages like this can give you a partial inflation hedge. For example, if you invested a portion of your funds at 65 you would receive a net income rate of 5.00% p.a. If you invested another portion of your funds at age 70 you would receive receive a net income rate of 5.50% p.a.

If you would like an inflation-protected income for life quote, please feel free to contact us today at retire@lifetimeincome.co.nz

*Inflation Protected product increases each year by an assumed long run CPI inflation rate of 2.30% per annum.

What could your income be?

Find out with the Lifetime Income Calculator.