News

19 April 2017

The 4 per cent Rule

There’s been a bit of noise in the media lately about the 4% rule.

The 4% rule suggests that it is safe to withdraw 4% of your retirement portfolio to live on every year of your retirement. You can also increase the amount you withdraw by 2% each year to adjust for inflation. This means that if you had a portfolio worth $100,000, you could withdraw $4,000 in the first year, $4,080 in the second year and so on.

Your portfolio is assumed to be a balanced fund made up of shares and bonds and your money is expected to last for around 30 years before it runs out.

The 4% rule was first devised by William Bengen in 1994 using historical returns from 1926-1976. Bengen found that if an investor had followed the above 4% rule over this time, their money would have lasted for at least 30 years.

However, today’s returns, interest rates, and market conditions are different to that of last century. The 4% rule has come under the spotlight and has been the subject of much debate recently. Earlier this year, well-known financial commentators, Martin Hawes and Liz Koh both took different views on the topic:

With sound arguments on both sides, we wanted to formulate our own view on the subject. All the following stats and facts come from a 2016 report on the topic by Morningstar, a well-known US-based investment research company.

The report states that the rule is a helpful rule of thumb but has 4 main drawbacks:

1) The 4% rule does not take into account fees and other charges

If we add a 1% p.a. annual management fee onto a balanced fund (50% US shares and 50% US bonds), then in the graph below you will see there are quite a number of years over the 1926-1976 period where fee-adjusted returns are under 4%. Had the original research taken into account fees, then it would not have recommended a safe withdrawal rate of 4% but rather something closer to 2.5%.

2) The 4% rule is only based on US data

If we look at historical data from different countries, you’ll see that the probability of drawing down your money at 4% p.a. and making it last 30 years varies widely. This graph shows us the probability of being able to do this in different countries with different financial markets. Looking at past data from New Zealand, if you wanted a 99% probability that your money would last 30 years, it would best to draw it down by only around 3% each year.

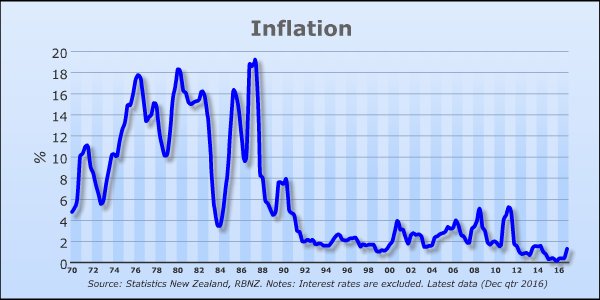

3) Historical returns are not an indicator of future returns

The 4% rule was devised using US data from 1926-1976. Inflation, which is a big driver of returns has fallen markedly since the 70s and 80s.The Reserve Bank of NZ graph below shows that inflation has fallen from 19% p.a. in 1987 to under 2% p.a. today.

Because of lower inflation and interest rates, returns are also predicted to be lower in the future, than they were in the past. Morningstar predicts that, going forward, the safe draw down rate for a balanced portfolio is now around 2.5% - 2.8% p.a.

4) We are living longer

All of the above points assume all money will be completely exhausted in 30 years. For some of us, retirement will be longer. The average 65-year-old woman in New Zealand is expected to live until age 90. This is just the average.

In Summary

The 4% rule has been a good rule of thumb for a safe withdrawal rate in the past. However due to lower inflation and interest rates today, it should probably be revised downwards to under 3%.

It’s also important to remember that under the 4% rule you are completely exposed to market risk and longevity risk.

Market risk is when your capital is affected by market downturns or a fall in interest rates. Your money also runs out faster when, in a falling market, you draw it down by the same rate. Longevity risk is when you outlive your savings. The 4% rule assumes will run down your savings after 30 years.

Lifetime can insure you from both market risk and the risk that you might outlive your money. It can also help you get a meaningful fortnightly income. For a 65-year-old, this is 5.00% p.a. (after fees and taxes). On an investment of $100,000 this translates to an annual income of $5,000 p.a. or $192 per fortnight, for life. If you are older than 65, your rate will be higher. Your money with Lifetime is not locked in and you can withdraw it (in part or full) at any time. If you pass away, your remaining account balance is paid to your estate.

What could your income be?

Find out with the Retirement Income Calculator.