News

5 July 2016

Martin Hawes: How long should my planning horizon be after retiring?

Martin Hawes runs the rule on his longevity

When planning your retirement, setting budgets and planning your retirement income needs, one of the key things you will have to consider is how long to plan for?

We are often asked exactly that question and have found that almost without exception people underestimate how long they could live.

In this article we use a new Actuaries Longevity Illustrator, now publicly available, to understand how long a planning horizon should Martin Hawes and his partner Joan be working to.

The links are at the bottom of the article – have a go and do it for yourselves!

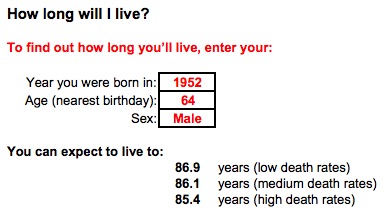

Life Expectancy: Martin to live to 86 and Joan to live to 89

Statistics New Zealand have a Life Expectancy calculator “How long will I live?” (link at the bottom of the article). It uses the actual death rates in New Zealand along with national population projections published in 2014.

It’s easy to use and gives a straight forwards answer.

However, life is rarely that simple!

Life Expectancy is an estimate of how long an individual of a certain age, gender and health would be anticipated to live on average. There is still a significant chance that you will live for many years beyond that.

Longevity: a 22% chance that Martin will live to 95 and a 33% chance that Joan will live to 95

Longevity is different and looks at how long you might actually live and does that by calculating different degrees of certainty (or probability) of living to a certain age. The American Actuaries Society have developed a publicly available Actuaries Longevity Illustrator that is easy to use and, whilst not based on New Zealand life tables, they are broadly comparable.

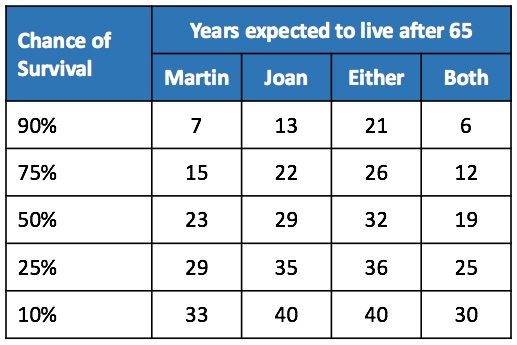

The chart below is one of the outputs of the illustrator for Martin and and Joan.

There is a 22% chance that Martin will live to 95 and a 33% chance that Joan will live to 95.

There is also a 14% chance that Joan will live to a 100!

Planning Horizon: what is your personal level of comfort when planning?

Having a planning horizon helps to give perspective when you consider your retirement income and spending.

You may be comfortable setting your planning horizon based on a 25% chance that you will survive at least that long. In Martin’s case (see table) the illustrator estimates that there is a 25% chance that Martin will live 29 years beyond 65. However, using a more cautious planning horizon, there is a 10% chance that Martin will live 33 years beyond 65.

In other words he has a 10% chance of living to 98.

Planning Horizon for a Couple

It's common practice of planning for each spouse or partner to be considered separately. That could lead you to underestimate by a number of years the length of time at least one of you will live.

Looking at the probabilities above, at the 25% chance planning horizon:

- There is a 25% chance that both Martin and Joan will both live for 25 years and then an additional 11 years where one will survive the other (36 years in total)

Taking a more cautious view and setting Martin and Joan’s planning horizon to a 10% chance:

- There is a 10% chance that both Martin and Joan will both live for 30 years and then an additional 10 years where one will survive the other (40 years in total)

Conclusions

The Longevity Illustrator is a simple tool to give individuals and couples a perspective on how long they may live and help inform the process of how they plan their retirement income.

Things get more complex when you are planning for two people, where consideration has to be given to “How long can we expect to live as a couple” and “How long can we expect the survivor to live afterwards”.

The Lifetime Income Fund is designed specifically for this purpose: to provide a guaranteed income for life, whatever that may be. But also to give people the flexibility to access their capital if they need to or to pay their estate.

Follow the links below to give it a go.

Thank you Martin and Joan for letting us use them as examples in the illustrator.