Retirement Life

11 February 2026

Funding your final years

Every decade of life brings different challenges. Perhaps that’s why we celebrate decade birthdays. There’s a kind of ‘rite of passage’ from one decade to the next, and the end of each brings an opportunity to plan ahead for the next one.

Turning 80 marks a significant milestone, not only for having reached such a good age, but also because the years ahead present challenges and uncertainties in terms of health, finances, and living arrangements. It’s important to plan ahead for those years because, while the end of life is inevitable, the aim is to live a long, healthy and happy life, not just a long life.

Why turning 80 matters

After the age of 80, the brain typically undergoes accelerated physical changes. These lead to slower processing speeds, reduced multitasking ability, and challenges with finding the right words or recalling names. It also takes a lot longer to learn new things and adapt to change. Not every brain ages at the same rate, and it is possible to delay decline with physical exercise, a healthy diet and ‘brain exercises’ aimed at maintaining cognitive ability. Nevertheless, making plans for the last ten years of life is better done well before decline sets in.

Preparing for the end

It's not easy to think about the end of life, but it is inevitable, and there are choices to be made about how and where you would like to be for those years. What does good quality of life look like for you? In the event you are not able to take care of yourself, who would you want to look after you or make decisions on your behalf? Will you have enough money to cover your needs and pay for care if required? Are your family members aware of your wishes?

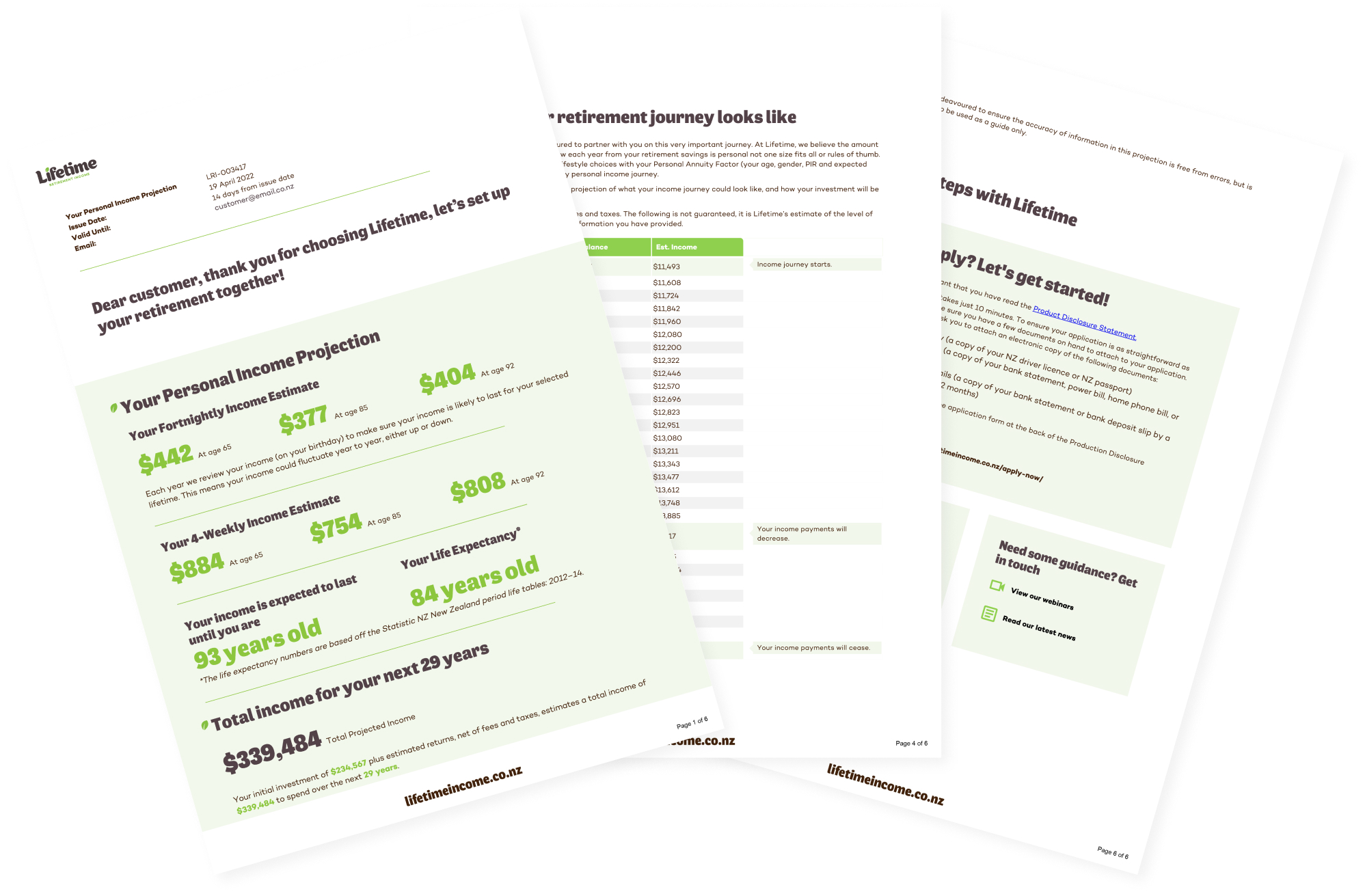

How much would you get a fortnight with Lifetime?

Dealing with the paperwork

Paperwork becomes much harder to do over the age of 80, so getting everything in order well before then is advisable. Make sure your will is up to date. Set up enduring powers of attorney with the help of your solicitor so that someone can act on your behalf if necessary.

Dealing with finances

Investments should be simplified if you are not using a professional adviser to manage them for you. Bills can be paid by direct debit or automatic payment. Paper records should be ruthlessly culled - keep only what is essential and store what’s left in an orderly fashion.

As you move through your last years, your investment focus shifts from achieving a good return to ensuring you have enough secure, easy-to-access cash on hand. These funds on hand should be sufficient to cover funeral expenses and healthcare.

You may want to think about how and when you provide for your family. Much pleasure can be gained from helping them financially while you are still alive. However, for large gifts, it pays to consult your lawyer or accountant to ensure it is done without complication.

Where to live

Your decision about where you wish to live in your final years will have a major impact on your finances. Downsizing to a smaller, newer home may require more than the value of your existing home. Moving to a retirement village replaces the costs of maintenance, insurance and rates with a weekly fee, which may be either a saving or an extra cost – something to be looked at before you move.

If you are counting on home equity release to fund your last years, consider how well your current home suits this purpose. For instance, a 'licence to occupy' in a retirement village will not usually qualify for home equity release. But using products such as Lifetime Home does mean you know exactly how much equity you still have available to you in your home. Keep in mind that if your home is later sold and you have used a reverse mortgage, you may be required to repay that reverse mortgage with accumulated interest. However, this is not the case with a product like Lifetime Home, which, unlike reverse mortgages, has no loan and no debt, so no compounding interest to worry about.

If you are a renter rather than a homeowner, finding a place to live that is comfortable and offers security of tenure is a major challenge.

Second-time relationships

When there is a second-time relationship in the mix, further consideration is needed for the arrangements made through wills and ‘contracting out’ agreements for what happens to the family home in the event of a death. There is a balance to be had between enabling children to receive their inheritance in a timely manner and the needs of a surviving partner for continuity in their living arrangements. It is not uncommon for people in the last stage of life to have to vacate their home on instruction of the executor of an estate.

End-of-life care

Conversations with family members about end-of-life care and arrangements are vital. Your family should have a good understanding of your wishes and know where your important information and documents are stored. Involving family members in your financial decisions is not always a good idea, as they may not have the necessary expertise and frictions can arise. Good professional advice in the last years of life will ensure your affairs run smoothly and give you peace of mind.

Project your retirement income.

Invest with Lifetime for a retirement income managed for living.