Retirement Life

3 September 2025

Are you eligible for a rates rebate?

Rates bills are one of those expenses that always seems to creep upwards. According to Stats NZ (Click to View), the local authority rates portion of the consumer price index increased 12.2% in the year to June 2025. That’s a big jump for anyone, but especially for retirees managing on a fixed income.

The good news is that help is available through the government’s rates rebate scheme, which offers partial refunds for eligible, low-income ratepayers. If you haven’t looked into it yet, it’s well worth checking whether you qualify.

What is the rates rebate scheme?

The scheme is designed to take some of the pressure off homeowners by reducing the amount they pay in council rates. It’s administered by the Department of Internal Affairs in partnership with local councils and is updated each year to reflect inflation and income levels.

For the 2025/26 year, the maximum rebate is $805. That’s not pocket change, it could cover a good chunk of your annual rates bill.

Who can apply?

You can apply if:

- You are the person named on the rates bill for your home.

- You were living in that home on 1 July 2025.

- You apply before 30 June 2026

You may also be eligible if you live in a retirement village or a company-share apartment, provided you have the right to occupy your unit and supply the correct declaration forms. Trust-owned properties may qualify too, if you are a named trustee on the rates bill.

Calculate what you could draw in retirement.

How much could you get?

The size of your rebate depends on three things: your income, your rates bill, and whether you have dependants. You can use the government’s online calculator (Click to View) to estimate your entitlement, but keep in mind it’s only a guide.

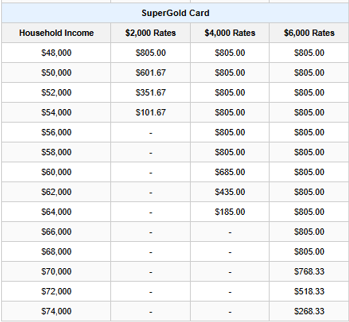

If you hold a SuperGold card, you may qualify for a higher rebate, just provide a copy of the card with your application.

Examples of the amount of rates rebate you may be entitled to with no dependants:

What counts as income?

This is the part where people sometimes get confused. For rebate purposes, your “household income” includes things like:

- New Zealand Superannuation or the Veteran’s Pension

- Personal superannuation or overseas pensions

- Wages, salary, or business income

- Interest, dividends, or PIE (portfolio investment entity) income

- Rental or trust income

- Work and Income benefits or supplements

- ACC compensation

You’ll need to include income from your partner or spouse if they live with you, but not from children or dependants.

What doesn’t count as income?

Here’s some good news for Lifetime customers:

- Payments from Lifetime Home do not count as income. That’s because they are capital payments. You’re effectively unlocking some of the equity in your property, not receiving earnings.

- Regular drawdowns of capital from Lifetime Income also does not count as income. These payments are a mix of your own invested capital and investment returns. This distinction is important as investment returns (from Lifetime Income and from Lifetime Invest if applicable) are classed as income. So, while your drawdown payments themselves may not all be “income,” the returns your investments have made over the annual period do need to be disclosed. You can find this information in your Lifetime customer portal or in your MyIR account.

- Think of it this way: if money you receive is essentially your own savings being paid back to you (like with Lifetime Home or the capital portion of a Lifetime Income drawdown), it’s not counted. But if it’s money earned from investments and taxable, it is.

Applying for the rebate

If you think you might be eligible, don’t delay. You’ll need to:

1. Complete an application form (available through your local council or the NZ Government website, here).

2. Provide proof of your income, e.g., an IRD summary of earnings, an investment income statement, or confirmation from Work and Income. Check your council website for their requirements.

3. Submit everything to your council before 30 June 2026.

If approved, your council will either deduct the rebate from your next rates instalment or refund you if you’ve already paid in full.

Why it matters

Rates are one of the biggest unavoidable costs for homeowners. For retirees, every dollar counts, and the rebate scheme can take real pressure off the household budget.

If you’re already a Lifetime customer, it’s reassuring to know that your Lifetime Home or Lifetime Income payments won’t reduce your chances of qualifying. Just remember to disclose any investment earnings.

So, if you haven’t already, check your eligibility. It could mean a lighter rates bill and a little more room in your budget for the things you’d rather be spending your retirement on.

Project your retirement income.

Invest with Lifetime for a retirement income managed for living.