Retirement Life

29 October 2025

How our retirement system stacks up and what it means for you

Each year, two major reports share valuable insights into how Kiwis are faring in retirement…and how ready we are for the decades we’re likely to spend there.

The first, the Mercer CFA Institute Global Pension Index, ranks the pension systems of 52 countries, measuring how generous, sustainable, and trustworthy each one is. The second, Massey University Fin-Ed Centre’s Retirement Expenditure Guidelines (REGs), dig into what retirees are actually spending —from food and rates to fun — to help Kiwis plan their financial futures.

Together, they tell an interesting story: our retirement system is good, but not great. And for many retirees, making ends meet comfortably takes more than a pension and a pat on the back.

A solid B, but room to improve

New Zealand held steady at 17th place out of 52 countries in the latest Global Pension Index (GPI), earning a B grade overall, putting us behind the Netherlands, Denmark, and Australia, but ahead of the US and Germany. We scored an A for integrity (Kiwis trust the system) but Bs for adequacy and sustainability, which means we could do more to ensure our retirement income lasts as long as we do.

Mercer suggests the solution is straightforward, if not simple:

- Raise the age of NZ Super gradually to reflect longer life expectancy (the ongoing debate).

- Lift KiwiSaver contributions beyond the current minimum (on its way).

- Tighten the rules around early withdrawals, to stop people “raiding the cookie jar” too soon.

- And crucially, help retirees turn their KiwiSaver savings into income, not just a lump sum.

The last point is key. Most of us have been taught how to save, but far fewer understand how to spend those savings wisely once we stop working. Which is exactly what drove Ralph Stewart to launch Lifetime Retirement Income a decade ago: to help kiwis draw a regular, reliable income from their nest egg.

How much would you get a fortnight with Lifetime?

Spring Seminar Series:

Take Control of Your Retirement Income

—Discover how you can enhance your retirement income by effectively leveraging your savings and home equity for greater comfort.

Why the average Kiwi is still topping up

The Massey University Fin-Ed Centre’s Retirement Expenditure Guidelines put real numbers around what retirement costs today, with the gap between NZ Super and actual spending hard to ignore.

Currently, NZ Super pays $538 a week for a single person and $828 for a couple.

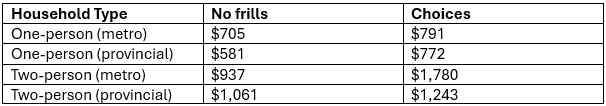

According to the study, though, even the most modest “no frills” lifestyle costs more than this. Below you can see the weekly household expenditures. Noting "no frills" is having coffee at home, and "choices" is going out for coffee at a cafe.

For a two-person household in a city, that’s nearly $1,000 a week more than NZ Super provides, or the equivalent of needing about $1 million in savings to fund the difference over a typical retirement.

Even those living a “no-frills” lifestyle need to supplement their income, either from savings, investments, or part-time work.

As report author Associate Professor Claire Matthews puts it: “Most retirees spend more than they receive from Super, and that’s entirely normal.”

Most retirees spend more than they receive from Super, and that’s entirely normal.

—Author Associate Professor Claire Matthews

The rising cost of staying put

While inflation has eased to around 2.7%, retirees have been hit hardest where it hurts most: food, power, and council rates. In fact, rates have jumped as much as 47% in Wellington in just three years.

For the two-thirds of retirees who own their homes outright, rising property costs are an unavoidable burden. And for those who rent, it’s even tougher: the median weekly rent is now over $620, climbing to $690 for a three-bedroom home.

So, while home ownership is a blessing, it’s also a cost centre. That’s why Lifetime’s home equity release product, Lifetime Home, has resonated with so many Kiwi retirees since launching last year.

“For retirees who are house rich but with little other cashflow, Lifetime Home offers a way to stay in the home you love while unlocking part of its value to support your income,” says Lifetime founder Ralph Stewart.

“It’s a debt-free home reversion option that lets you tap into your biggest asset — your home — without the stress of repayments or moving out.”

It’s an elegant solution to a very Kiwi dilemma: a valuable home, but not enough liquid cash to live comfortably.

Want to know more?

Turning savings into security

Both reports land on a common truth: the challenge isn’t just saving for retirement, it’s living through it.

That’s where the right financial tools make all the difference. Lifetime’s Retirement Income Fund is designed for exactly this stage of life, allowing retirees to draw a regular income from their investments while keeping their money invested in a diversified fund. It offers flexibility, stability, and peace of mind, especially when paired with other sources like NZ Super or Lifetime Home.

As Stewart puts it, “Managing money over a 20- or 30-year retirement is complex. Our role is to make it easier, by providing solutions that adapt to people’s needs and give them confidence that their income will last as long as they do.”

The takeaway

If the GPI tells us how New Zealand’s pension system compares, and the REGs tell us what it can actually cost to retire here, then together they give retirees a useful map and a few signposts for the road ahead.

Yes, NZ Super is a vital safety net. Yes, KiwiSaver is maturing into a powerful savings tool. But neither replaces the need for personal planning, which means structuring your savings, your income, and even your home in ways that make your retirement sustainable and enjoyable.

Invest with Lifetime for a retirement income managed for living.