Retirement Life

27 May 2025

Is the retirement income system fit for purpose?

Back in October 2020 the Retirement Commissioner, Jane Wrightson, worked with an expert panel to create a purpose statement for New Zealand’s retirement income system. This system consists of NZ Superannuation, KiwiSaver and private savings. The resulting purpose statement reads:

“A stable retirement income framework enables trust and confidence that older New Zealand residents can live with dignity and mana, participate in and contribute to society, and enjoy a high level of belonging and connection to their whanau, community and country.

To help current and future retirees to achieve this, a sustainable retirement income framework’s purpose is twofold:

1. To provide NZ Superannuation to ensure an adequate standard of living for New Zealanders of eligible age. NZ Super is the Government’s primary contribution to financial security for the remainder of a person’s life.

2. To actively support New Zealanders to build and manage independent savings that contribute to their ability to maintain their own relative standard of living.

The retirement income system sits within the broader government provision of infrastructure also needed to enable older New Zealanders to live well, such as health care, housing and transport.”

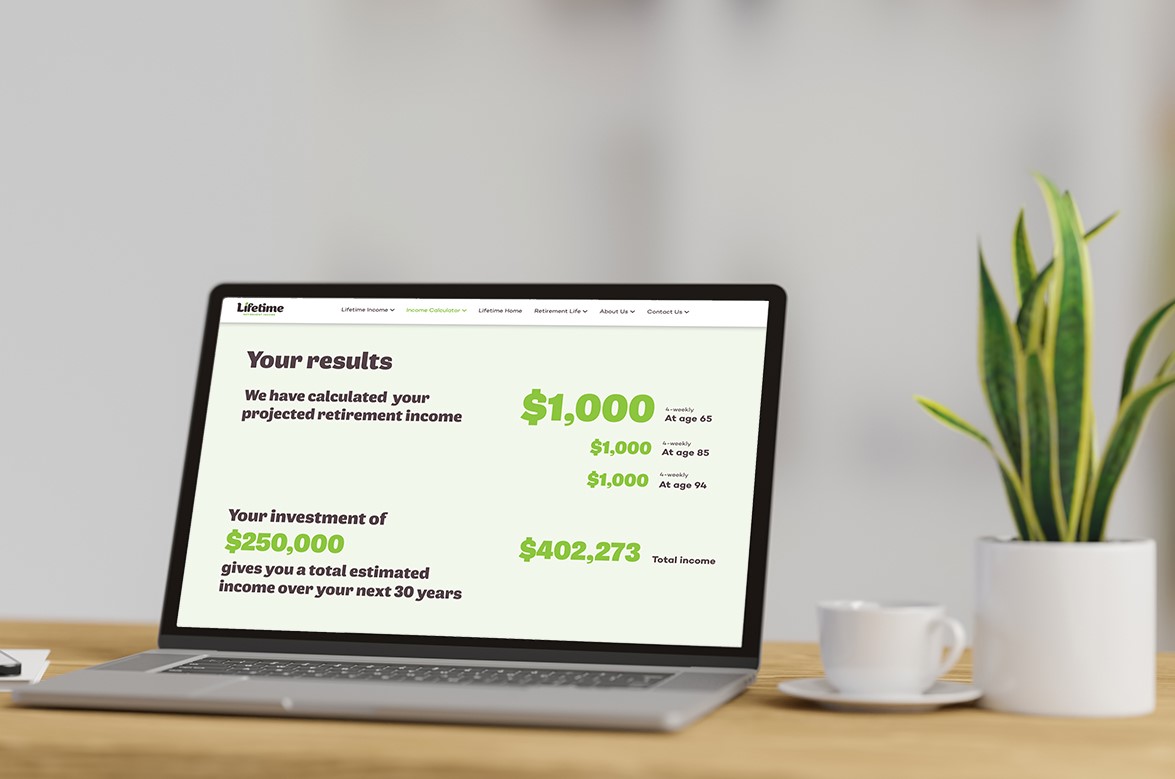

Calculate what you could draw in retirement.

How is it tracking?

The purpose statement is intended to be used to gauge the effectiveness of retirement income policies. So how did the Government do in its latest budget?

The budget includes an increase in government spending on NZ Super of about 6%. However, this is not a policy change. It’s driven by the increasing number of people reaching retirement age and the annual inflation adjustment to payments. As with most other government budgets, the focus this year is not on retirees, but on young families, the unemployed and businesses. It would be a welcome change to see a budget that specifically addressed the needs of retirees.

Good news for (some) retired ratepayers

There is a little bit of good news for SuperGold cardholders. The rates rebate scheme will now have a maximum rebate of $805 (up from $790) and the income threshold for eligibility will be lifted from $31,500 to $45,000 – about the income of a couple receiving superannuation. This should see around 66,000 more people being eligible for the rebate.

However, the rates rebate does little to help people who work beyond the age of 65, either by choice or because they can’t afford not to, as their incomes will most likely make them ineligible. Nor does it solve the problem identified through the Massey University Retirement Expenditure Guidelines which shows clearly the substantial gap between NZ Super and actual living costs in retirement.

Taking a chisel to KiwiSaver

The Government is concerned about the increasing cost of supporting the retirement income system. The underlying message appears to be one of encouraging people to provide for themselves when they retire. To that end, the annual tax credit paid to KiwiSaver members has been halved for the second time, taking it to around $250, while the minimum contribution for both KiwiSaver members and their employers will increase from 3% to 4% over the next couple of years.

Some employers pay their staff on a total remuneration package which includes KiwiSaver contributions. This means some may face a 2% reduction in salary unless their total remuneration is increased to reflect the change. Meanwhile, for the self-employed, the $250 tax credit doesn’t provide a meaningful incentive to join KiwiSaver.

You could argue that KiwiSaver has matured to an extent that people no longer need incentives to join. Perhaps the next step is to eliminate the tax credit altogether and/or to make KiwiSaver compulsory. This would be one way of strengthening the retirement income system without an additional cost burden on the government, but it would make it even harder for those struggling on low incomes.

Health and homes

As noted in the Retirement Commission’s purpose statement, healthcare, housing and transport are also key to living well in retirement. The budget increase in healthcare spending is good news for retirees, many of whom end up on long waiting lists for surgery and specialist appointments. However, there is no mention of the plight of the growing number of retirees who rent or are still paying off a mortgage. Innovative housing and finance solutions are necessary to protect them from sinking into poverty.

Perhaps it’s time for retirees to have a louder voice and advocate for a sustainable retirement income framework that more fully reflects its purpose.

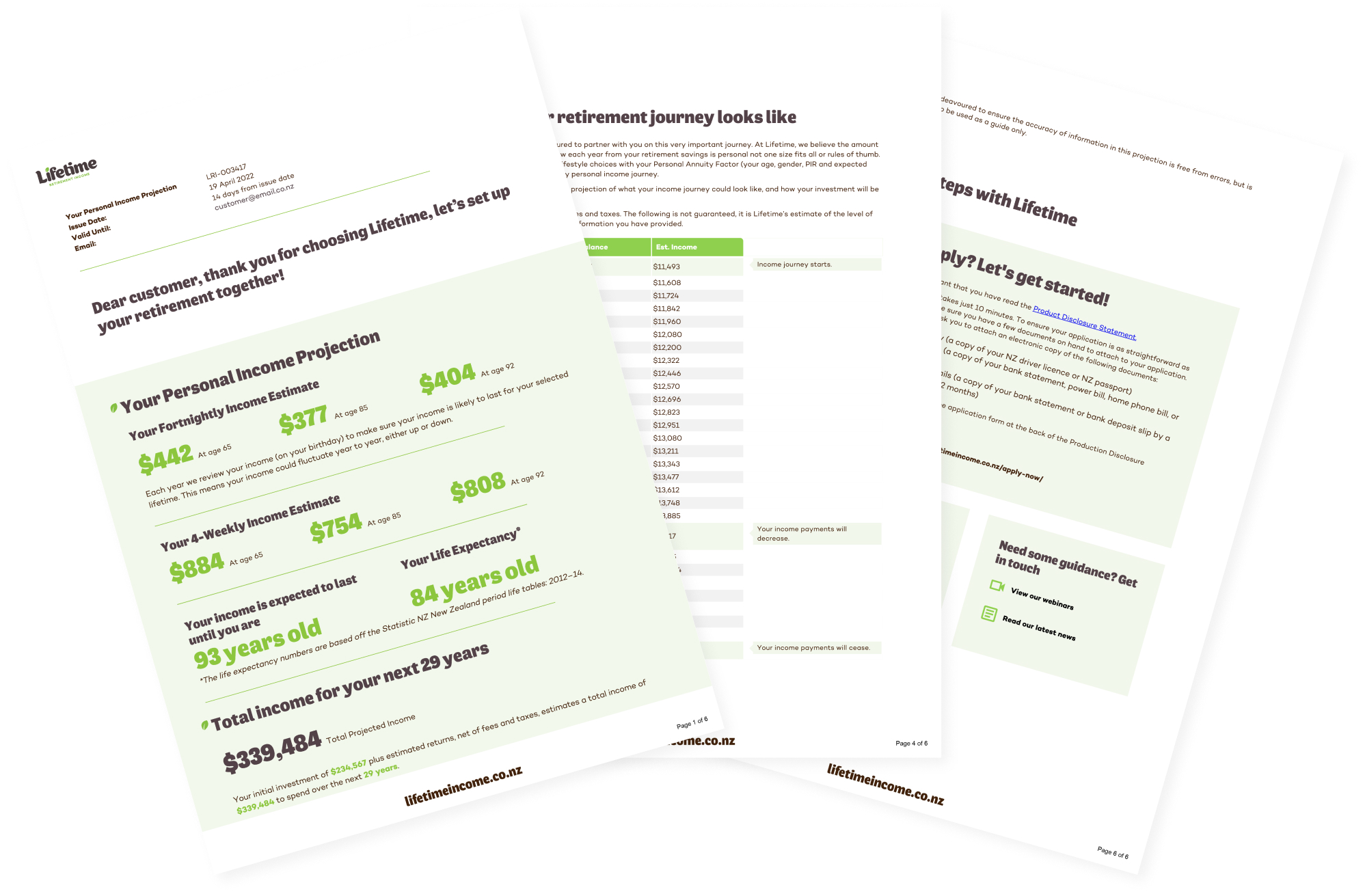

Project your retirement income.

Invest with Lifetime for a retirement income managed for living.