News

30 July 2018

Are term deposits your own worst enemy?

Term deposits are one of the most popular investments in New Zealand. It’s easy to see their attraction; they’re pretty secure and offer investors a known rate of return for the term of the investment. However, there are 7 key risks and downsides most people don’t consider...

1. Automatic renewals

Investors should beware of any automatic rollover conditions before they enter any term deposit. Often, matured term deposits may be rolled automatically to a new term, however, when this occurs you may not get the best rate. Some banks have been known to offer a very attractive interest rate for the initial term, but, once the term is completed, the rate for a similar term can be significantly less attractive!

2. Vulnerability to inflation

While the fixed rate of return on term deposits can be an advantage, this can make term deposits particularly vulnerable to inflation.

In the simplest terms, the value of a term deposit can be eroded if inflation increases quickly. Even recent levels of low inflation in New Zealand (and worldwide) can be disastrous to your term deposit returns over the long-term, as further explained in point three below.

3. Low risk means low returns

Most financial commentators agree that a term deposit is still one of the safest investments available, even if they’re not guaranteed (see point four). However, this security comes at a price: low returns. After tax is paid, and a steady rate of inflation is accounted for, in some cases the real return on a term deposit can even be negative!

Because of these low returns, most commentators expect most other investment classes to outperform term deposits over the long term. This means that, over long periods of time, those who have sought the security of term deposits may be less financially secure than those who invested is assets that offer greater returns.

4. No guarantee

Concentrating your investments is the opposite to the well-known investment principle of diversification. For years, banks have been perceived as a safe place to hold funds, however this needs to be taken with a grain of salt.

So far, New Zealand and Australia have avoided severe financial crises like the Asian financial crisis of the late 1990’s and the more recent Global Financial Crisis (GFC) of the late 2000’s. Despite this, we haven’t been entirely immune to shocks, and in 1990 the largest bank in New Zealand at the time, Bank of New Zealand (BNZ), had to be bailed out by the government. Between 2006 and 2012, more the 50 finance companies failed, costing over 150,000 investors over $3 billion.

If one of the major banks gets into financial trouble, many assume that taxpayers will come to the rescue just like they did in 1990 for BNZ. However, since the GFC, many countries, including New Zealand, have developed policies that enable even large bank failures to be handled in ways that minimise the chances of a taxpayer bail-out. This is by forcing shareholders, then creditors (including depositors) to absorb losses. The Reserve Bank's Open Bank Resolution policy is designed to enable bank failures to be managed in this way.

A survey conducted for the Financial Markets Authority in 2014 revealed that most respondents thought that New Zealand bank term deposits come with a guarantee. In fact, New Zealand is one of only two OECD nations to not have a guarantee of some description. Therefore, deposits in New Zealand banks receive minimal protection. This lack of guarantee means that if your bank fails, your funds are at risk of either total lock out or being partially frozen.

5. Illiquidity

Even if you’re entering a term deposit with the best intentions and are mentally prepared to lock away your funds to gain a small return, changes in life do occur. This could be an unforeseen expense, such as dental treatment or car repairs, or it could be an opportunity – such as a family member with a successful business asking if you’d like to invest to help fund expansion.

By locking funds into a fixed term, holders of term deposits lock their funds into bank control until the maturity date of the term deposit unless the term is broken.

6. Reduced rate or penalty for early withdrawals

Policies on this vary by bank, though it’s common for a bank to forfeit the interest you have accrued if you break a term deposit before the term has ended. Some banks have other penalties and implications.

If you’re entering a term deposit, then reading all the fine print and being aware of what an early exit will cost you – or whether it is available – will help you make a more informed decision before you commit your hard-earned funds for a set period.

7. Opportunity cost

As most other investments are expected to outperform term deposits over the long run, there is a huge opportunity cost to investing in term deposits over the medium to long term.

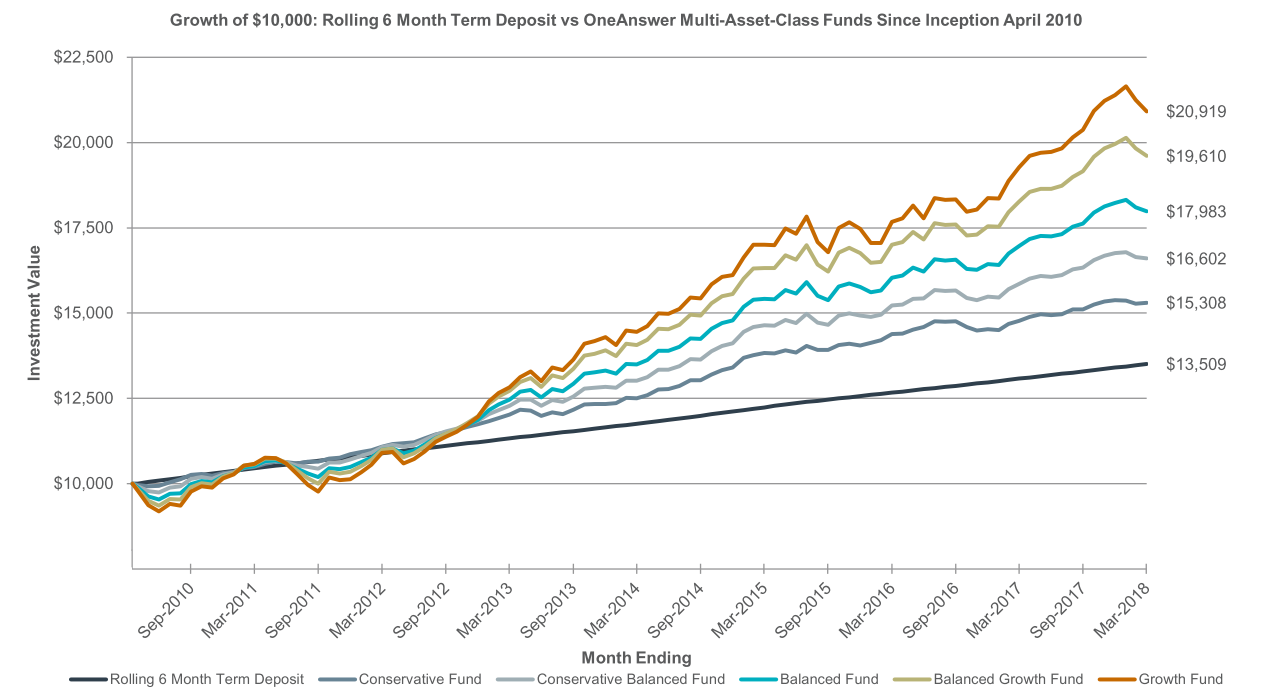

To illustrate this, the graph below shows different growth paths of a $10,000 investment made in September 2010. The black line shows reinvested rolling six-month term deposits, while the other lines show a range of different managed fund investment choices.

Growth of $10,000: rolling 6-month term deposit vs multi asset class managed fund since April 2010

Image credit: ANZ Investments (NZ) Ltd.

While acknowledging that past performance does not indicate future returns, the graph above shows quite clearly that anyone investing solely in term deposits over this period has achieved a significantly lower return than if they’d invested elsewhere.

The bottom line

While term deposits remain a comparatively safe option, especially if funds are needed for the next two or three years, keep in mind their risks and drawbacks:

1) Automatic renewals can potentially lower your interest rate in the future

2) Concentrated risk with banks that aren’t guaranteed

3) Lack of liquidity and flexibility to withdraw money

4) Penalties or loss of interest for early withdrawals

5) Vulnerability to inflation, especially if inflation was to increase rapidly

6) Low returns when compared to other asset classes

7) Opportunity cost of missing out on higher returns, especially over the long term

This article has been contributed by Joseph Darby, CEO and authorised financial adviser at Milestone Direct Ltd. This article first appeared on the Milestone Direct website. The views and opinions expressed in this article are those of Joseph Darby and not necessarily those of Milestone Direct Ltd. The views and opinions expressed in this article are intended to be of a general nature and do not constitute personalised advice for an individual client. A disclosure statement relating to Joseph Darby is available, on request and free of charge.

Retire your risk: Free event with Liz Koh

Join leading financial commentator & retirement planner, Liz Koh for a free event designed to help you answer the big questions in retirement.

1) Transitioning from saving to spending

2) Investments, KiwiSaver, & property

3) Rest home subsidies, health insurance, & family trusts

4) Insured income for life (presented by Lifetime)

5) Reverse mortgages (presented by Heartland Bank)

Events held throughout regional North Island only.

Refreshments provided. Spaces limited. Reserve your free place now.