News

4 December 2018

How can Lifetime protect you from a market crash?

International share markets have taken a tumble recently and volatility is still hanging around...

So what can Lifetime do to help protect you from market risk?

When you invest with Lifetime, your savings are invested in a balanced fund and your income is insured for life.

The balanced fund is similar to a KiwiSaver fund and invests your savings in an internationally diversified portfolio of listed shares and bonds.

The investment return from this fund will fluctuate in line with market returns. This means that in some years, returns will be higher than other years.

While your investment returns may change, your regular income is insured for life. Your income can rise with positive returns, but it cannot fall, even if markets fall and investment returns are negative.

Each year, your Insured Income Base (the base from which your Insured Income is calculated) is reset to the higher of your investment account balance or its present value.

This locks in annual returns and protects your future income from market volatility. While your account balance will fluctuate with investment markets, your Insured Income Base will not.

Let's use an example...

Say you invested $200,000 at age 65.

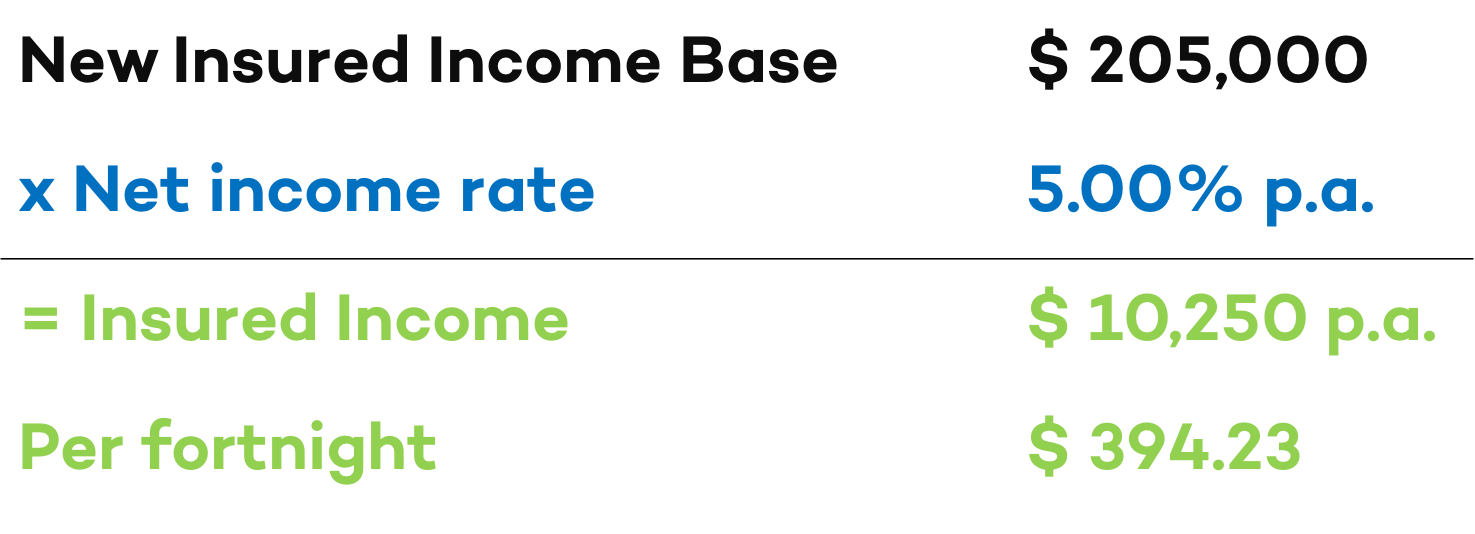

Your Insured Income Base would be set equal to your initial investment of $200,000 and your net income rate would be 5.00% per annum.

This would give you a net Insured Income of $10,000 each year (after fees and tax), paid into your bank account at a rate of $384.62 every fortnight for life.

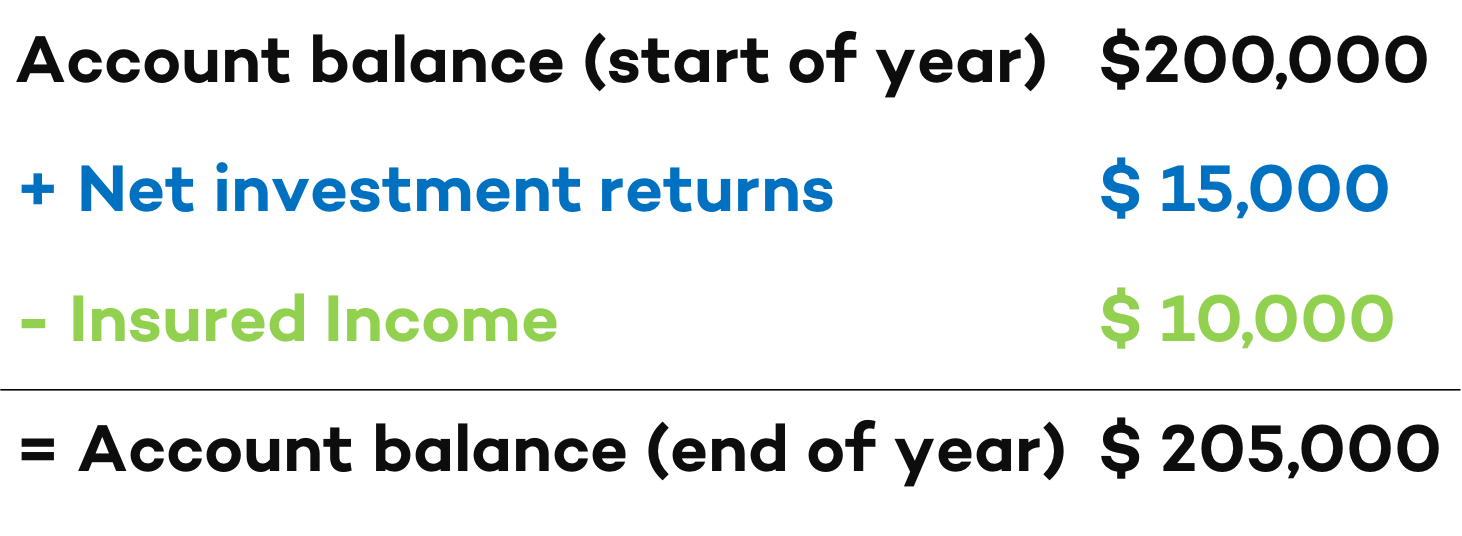

In the first year, let's say the fund earns a net annual return of 7.50% or $15,000. After receiving your regular income payments totalling $10,000, your account balance would be $205,000 at the end of the year.

At your annual account review, your Insured Income Base is increased to $205,000 and your Insured Income rises to $10,250 a year (5.00% of your new Insured Income Base of $205,000) or $394.23 each fortnight, for life.

But what if markets fall?

Now let's look at what might happen if there were a market crash and global shares markets fell by 20%.

Because Lifetime is a balanced fund, around half of the portfolio could be affected (the other half is invested in bonds, fixed interest, and cash).

Simplistically, this might mean that the total balanced fund drops in value by 10%, meaning that the initial investment of $200,000 receives negative returns of -$20,000 over the year.

After subtracting your annual Insured Income payments totalling $10,000, your account balance is now $170,000.

Although your account balance has been depleted, your Insured Income Base cannot fall and remains at $200,000. This means you continue to receive your net income payments of $10,000 every year (5.00% of your Insured Income Base) or $384.62 for the rest of your life.

By reducing your capital, the market crash has not reduced your income but it has increased the possibility that you will drawdown your investment over your retirement. This means it has also brought forward the probability of you calling on Lifetime's longevity insurance to continue paying your regular income for life.

Because of this, Lifetime has the incentive to reduce your market volatility by as much as possible. As soon as your capital is drawn down, Lifetime as an insurer must pay your regular income payments for as long as you live.

What if markets fall but you have not started income yet?

Let's say you're 62 and have just invested $100,000 but don't want to start income until you retire at age 67. What happens if there's a market downturn during this time?

Your Insured Income at 67 will be at least $5,200 per annum (or $200 each fortnight) regardless of market volatility or how long you live. This is based on a minimum Insured Income Base of $100,000 and a net income rate of 5.20% per annum.

However, it’s likely that your Insured Income will be higher as investment returns during your deferral period will increase your income. Each year from age 62, your Insured Income Base will be reviewed and locked in to reflect market growth. However if markets fall, your Insured Income Base will stay the same.

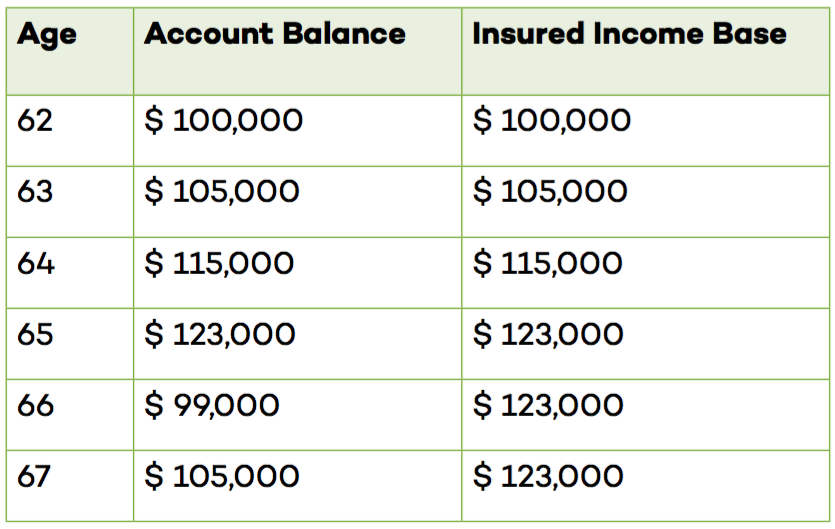

The table shows how this might look in a market that drops and then recovers.

At 62, your Insured Income Base is equal to your initial investment of $100,000.

Markets perform well from age 62 to 65 and your investment account balance increases. Each year, on the anniversary of your investment, your Insured Income Base is automatically increased to lock in these gains.

However, there is a market downturn when you are 66, and your account balance falls from $123,000 to $99,000. Although your account balance has fallen, your Insured Income Base and future income have not.

The market recovers slowly in the following year and your account balance increases to $105,000. When you start receiving your Insured Income at 67, it is calculated on your highest Insured Income Base of $123,000.

At 67, your net income rate is 5.20% per annum. On an Insured Income Base of $123,000, your net Insured Income will be $6,396 per annum, paid into your bank account at a rate of $246 every fortnight, for the rest of your life.

What could your insured income be?

Find out with the Lifetime Income Calculator.